Embark on a comprehensive journey through Accounting 2036 Mizzou Exam 2. This guide unravels the intricacies of the exam, equipping you with the knowledge and strategies to conquer it with confidence. Dive into the exam structure, content coverage, and effective preparation techniques to maximize your success.

As you delve deeper, discover sample exam questions that mirror the actual test, providing invaluable practice. Analyze past exam performance to identify areas for improvement and gain insights into common strengths and weaknesses. Leverage the wealth of exam resources available, including textbooks, study guides, and online materials, to enhance your preparation.

Exam Structure: Accounting 2036 Mizzou Exam 2

The Accounting 2036 Mizzou Exam 2 consists of multiple-choice questions, true/false questions, and short-answer questions. The exam has a time limit of 90 minutes and is worth a total of 100 points.

The grading scheme is as follows:

- Multiple-choice questions: 2 points each

- True/false questions: 1 point each

- Short-answer questions: 10 points each

There is no penalty for incorrect answers.

Content Coverage

Exam 2 of Accounting 2036 at Mizzou covers a range of accounting topics, delving into both the theoretical foundations and practical applications of accounting principles. The exam assesses students’ understanding of these concepts and their ability to apply them to various accounting scenarios.

The exam encompasses a comprehensive array of accounting topics, including:

Statement of Cash Flows

- Purpose and importance of the statement of cash flows

- Classification of cash flows into operating, investing, and financing activities

- Preparation of the statement of cash flows using the indirect method

- Analysis and interpretation of cash flow data

Time Value of Money

- Concepts of present value, future value, and annuities

- Calculation of present and future values using various time value of money formulas

- Applications of time value of money in capital budgeting and investment decisions

Bonds

- Characteristics and types of bonds

- Bond valuation and pricing

- Bond amortization and effective interest method

Leases

- Classification of leases as operating or capital leases

- Accounting for operating and capital leases from both the lessee’s and lessor’s perspectives

Exam Preparation Strategies

Effective exam preparation requires a comprehensive approach encompassing efficient study methods, time management, note-taking, and practice. Understanding the strategies to tackle challenging concepts and memorize key information will enhance your preparation.

Effective Study Methods

- Active Recall:Regularly test your understanding by recalling concepts without referring to notes, forcing your brain to retrieve information and strengthen connections.

- Spaced Repetition:Review material at increasing intervals (e.g., 1 day, 3 days, 1 week) to improve long-term retention.

- Elaboration:Connect new information to existing knowledge by explaining concepts in your own words or creating analogies.

- Interleaving:Mix up different topics while studying to enhance understanding and prevent boredom.

Time Management

Create a realistic study schedule that allocates specific time slots for different topics. Break down large tasks into smaller chunks to make them less daunting. Use a planner or calendar to track your progress and stay organized.

Note-Taking

- Concise and Focused:Take notes that capture the essence of the material, avoiding unnecessary details.

- Organized and Structured:Use headings, subheadings, and bullet points to create a logical flow of information.

- Active Listening:Engage actively in lectures and discussions, taking notes that reflect your understanding.

- Review and Revise:Regularly review your notes to reinforce concepts and identify areas that need further attention.

Practice Questions, Accounting 2036 mizzou exam 2

Solving practice questions is crucial for assessing your understanding and identifying areas where you need more practice. Use textbooks, online resources, or past exam papers to find relevant questions.

It’s time to get serious about your Accounting 2036 Mizzou Exam 2. If you need a break from studying, why not delve into the timeless tale of Romeo and Juliet? Check out the timeline of romeo and juliet to learn about their tragic love story.

When you’re done, come back refreshed and ready to ace that exam!

Addressing Challenging Concepts

- Break Down the Concept:Divide complex concepts into smaller, manageable parts to make them easier to understand.

- Seek Clarification:Ask your professor, classmates, or a tutor for help if you encounter difficulties.

- Visualize and Connect:Create diagrams, mind maps, or other visual aids to represent the concept and connect it to related knowledge.

Memorizing Key Information

- Mnemonic Devices:Use acronyms, rhymes, or other memory tricks to make it easier to remember key terms and formulas.

- Flashcards:Create flashcards with questions on one side and answers on the other for effective memorization.

- Chunking:Break down large amounts of information into smaller, manageable chunks to enhance recall.

Example Questions

The following table presents various sample exam questions to familiarize students with the types of questions they can expect on Exam 2.

The questions cover different difficulty levels and encompass diverse accounting topics, providing a comprehensive overview of the exam content.

Multiple Choice Questions

Multiple choice questions require students to select the best answer from a list of options.

- Which of the following is not a type of financial statement?

- Balance sheet

- Income statement

- Statement of cash flows

- Statement of retained earnings

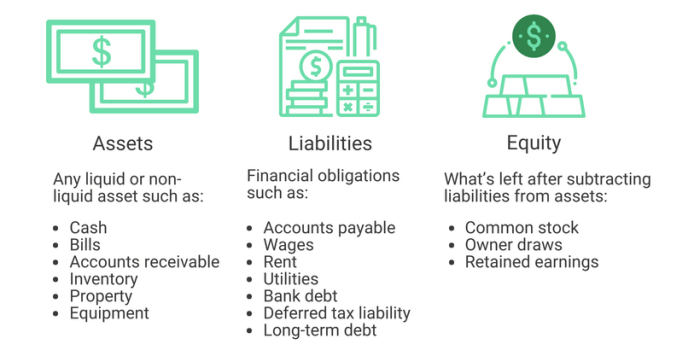

- What is the accounting equation?

- Assets = Liabilities + Equity

- Assets + Liabilities = Equity

- Liabilities = Assets – Equity

- Equity = Assets – Liabilities

- Which of the following is a current asset?

- Cash

- Inventory

- Land

- Building

Short Answer Questions

Short answer questions require students to provide a concise and specific answer.

- Define depreciation.

- Explain the difference between a debit and a credit.

- What is the purpose of an income statement?

Essay Questions

Essay questions require students to demonstrate a comprehensive understanding of a topic and provide a well-organized and supported response.

- Discuss the importance of internal controls in an organization.

- Explain the accounting cycle and how it is used to prepare financial statements.

- Analyze the impact of a change in accounting policy on a company’s financial statements.

Past Exam Analysis

Past exam performance in Accounting 2036 at Mizzou has provided valuable insights into areas where students excel and struggle. Analyzing these trends can help current students identify potential challenges and develop effective exam preparation strategies.

Overall, students have demonstrated a strong understanding of the fundamental concepts and theories covered in the course. However, certain areas have consistently posed challenges, requiring additional attention and focus.

Common Strengths

- Solid grasp of accounting principles and concepts

- Ability to apply theoretical knowledge to practical scenarios

- Effective use of accounting terminology and standards

Common Weaknesses

- Difficulty in applying advanced accounting concepts to complex transactions

- Challenges in interpreting and analyzing financial statements

- Errors in journalizing and posting transactions

Areas for Improvement

To enhance exam performance, students are encouraged to:

- Practice applying advanced accounting concepts to various transaction scenarios.

- Develop strong analytical skills for interpreting and understanding financial statements.

- Review journalizing and posting procedures to minimize errors.

Exam Resources

Exam preparation doesn’t have to be daunting with the right resources at your disposal. To ace your Accounting 2036 Mizzou Exam 2, leverage the following:

Textbooks and Study Guides

- Required Textbook: Intermediate Accounting, 13th Edition by Kieso, Weygandt, and Warfield

- Study Guide: Intermediate Accounting Study Guide, 13th Edition by Kieso, Weygandt, and Warfield

Online Materials

- Mizzou Course Website: Access lecture notes, practice problems, and announcements

- Canvas Discussion Board: Engage with classmates and seek clarification from the professor

- YouTube Channels: Search for videos on specific accounting concepts and exam preparation strategies

Additional Support

Beyond these resources, don’t hesitate to seek additional support:

- Attend office hours: Get personalized guidance from your professor or TAs

- Form study groups: Collaborate with peers to reinforce concepts and tackle practice problems

- Utilize online forums: Join accounting communities and engage in discussions with professionals and students

Popular Questions

What is the exam format for Accounting 2036 Mizzou Exam 2?

The exam typically consists of multiple-choice questions, short answer questions, and case studies.

How much time is allocated for the exam?

The exam duration is usually around 2 hours.

What topics are covered in the exam?

The exam covers various accounting concepts, including financial accounting, managerial accounting, and auditing.