Embark on a captivating journey with A Tale of Two Savers Answer Key, a comprehensive guide that unravels the intricate tapestry of saving, investment, and financial well-being. Through the lens of two contrasting savers, this narrative explores the profound impact of financial literacy and empowers individuals to navigate the complexities of personal finance.

Delving into the depths of this literary masterpiece, we’ll dissect the economic principles that underpin the savers’ actions, analyze their saving strategies, and uncover the factors that shape their contrasting financial outcomes. Prepare to be immersed in a world of financial wisdom and practical insights, leaving you equipped to make informed decisions and achieve your financial aspirations.

Literary Analysis of “A Tale of Two Savers”

In “A Tale of Two Savers,” E.B. White weaves a poignant and insightful narrative that explores the complexities of human nature, particularly in relation to the virtues of thrift and generosity.

Central Themes and Motifs

The central theme of the story revolves around the contrasting approaches to saving money adopted by the two main characters, Elmer and Edward. Elmer, a miserly hoarder, embodies the extreme of excessive thrift, while Edward, a selfless giver, represents the opposite end of the spectrum.

White uses these characters to explore the virtues and pitfalls of both extremes, ultimately suggesting that a balanced approach to saving and giving is the most fulfilling.

Another prominent motif in the story is the use of symbolism and imagery. The overflowing closet and barn that Elmer obsessively fills with his savings serve as symbols of his insatiable greed and the emptiness it brings to his life.

Conversely, Edward’s humble cottage, adorned with the gifts he has given to others, represents the joy and fulfillment that comes from sharing one’s wealth.

Characterization and Development

The characterization of Elmer and Edward is central to the story’s impact. Elmer is portrayed as a lonely and isolated figure, consumed by his relentless pursuit of wealth. His lack of empathy and unwillingness to help others paint a picture of a deeply flawed and unhappy individual.

Edward, on the other hand, is depicted as a kind and compassionate man who finds joy in giving to others. His selfless nature and willingness to share his wealth create a stark contrast to Elmer’s miserly ways.

Symbolism and Imagery

White’s use of symbolism and imagery throughout the narrative adds depth and resonance to the story. The overflowing closet and barn that Elmer fills with his savings represent the emptiness and isolation that his greed brings to his life. In contrast, Edward’s humble cottage, adorned with the gifts he has given to others, symbolizes the joy and fulfillment that comes from sharing one’s wealth.

The story also employs animal imagery to reinforce the contrasting characters of Elmer and Edward. Elmer is likened to a squirrel, frantically gathering and hoarding his nuts, while Edward is compared to a generous bird, freely sharing its bounty with others.

Economic Principles in “A Tale of Two Savers”

The story of the two savers illustrates several key economic concepts, including saving, investment, and risk management. The savers’ actions demonstrate the importance of these concepts in achieving financial well-being.

Saving

Saving is the act of setting aside money for future use. It is an essential part of financial planning and allows individuals to accumulate wealth over time. The two savers in the story have different saving habits: Saver A saves regularly, while Saver B spends most of their income.

- Saver A’s regular saving habits demonstrate the principle of delayed gratification. They are willing to sacrifice immediate consumption to secure their financial future.

- Saver B’s spending habits, on the other hand, illustrate the concept of present bias. They prioritize immediate gratification over long-term financial goals.

Investment

Investment is the process of using money to generate additional income or wealth. It can involve purchasing stocks, bonds, or real estate, among other options. The two savers in the story have different investment strategies:

- Saver A invests their savings in a diversified portfolio of stocks and bonds. This strategy aims to maximize returns while managing risk.

- Saver B does not invest their savings. Instead, they keep their money in a low-yield savings account.

Risk Management, A tale of two savers answer key

Risk management is the process of identifying and mitigating financial risks. It involves diversifying investments, managing debt, and planning for unexpected events. The two savers in the story have different approaches to risk management:

- Saver A diversifies their investments to reduce risk. They invest in a mix of stocks, bonds, and real estate, which have different risk profiles.

- Saver B does not diversify their investments. They keep their money in a single savings account, which exposes them to greater risk.

Impact of Saving Strategies on Financial Well-being

The different saving strategies of the two savers have a significant impact on their financial well-being. Saver A’s regular saving and investment habits allow them to accumulate wealth and achieve financial security. Saver B’s spending habits and lack of investment result in financial instability and a lower standard of living in retirement.

The story of the two savers highlights the importance of saving, investment, and risk management in achieving financial well-being. By following these principles, individuals can secure their financial future and live a more comfortable life.

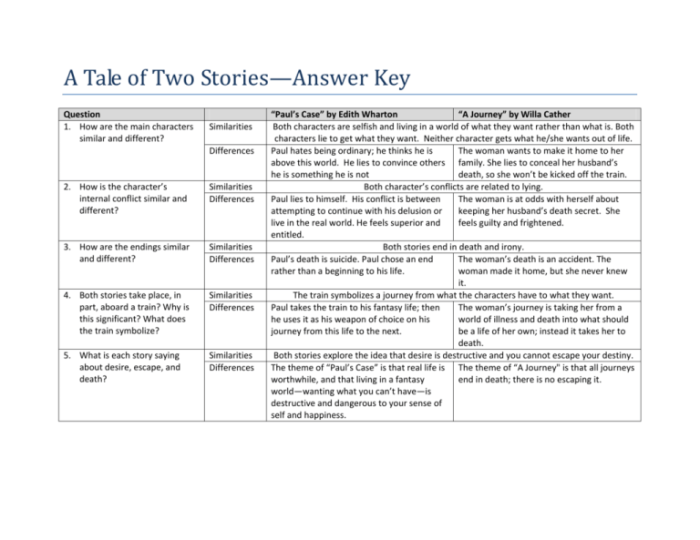

Comparison and Contrast of Saving Habits: A Tale Of Two Savers Answer Key

In “A Tale of Two Savers,” we encounter contrasting saving habits that lead to vastly different financial outcomes. To better understand these differences, let’s compare the saving habits of the two savers.

Income and Expenses

Both savers have similar incomes. However, their spending habits differ significantly. Saver A spends a larger portion of their income on non-essential items, while Saver B prioritizes saving and essential expenses.

While searching for the answer key to “A Tale of Two Savers,” you may also be interested in exploring the analogy between a cell and a city. Just as a cell is the basic unit of life, a city is the basic unit of civilization.

Check out the cell city analogy answers key to delve deeper into this fascinating comparison, and then return to “A Tale of Two Savers” to continue your quest for financial wisdom.

| Income | Expenses | |

|---|---|---|

| Saver A | $50,000 | $40,000 |

| Saver B | $50,000 | $30,000 |

Savings Rate

Saver B has a much higher savings rate than Saver A. Saver B saves approximately 40% of their income, while Saver A saves only 20%. This difference in savings rate is a key factor contributing to their contrasting financial outcomes.

Investment Strategies

Saver B invests their savings in a diversified portfolio of stocks and bonds. This strategy provides the potential for higher returns over the long term. Saver A, on the other hand, keeps their savings in a low-yield savings account, which earns minimal interest.

Factors Contributing to Contrasting Outcomes

The contrasting saving habits of the two savers are influenced by several factors, including their financial goals, risk tolerance, and financial literacy. Saver B’s higher savings rate, diversified investment strategy, and long-term financial planning contribute to their financial success.

The Importance of Financial Literacy

Financial literacy is crucial for individuals and society. It empowers people to make informed financial decisions, manage their money effectively, and achieve financial security. It also fosters economic stability and growth.

“A Tale of Two Savers” vividly illustrates the consequences of poor financial decisions. Emily, despite her high income, struggles financially due to excessive spending and poor budgeting. On the other hand, Raj, with a modest income, becomes financially secure through disciplined saving and wise investment.

Strategies for Promoting Financial Literacy

Promoting financial literacy requires multifaceted strategies targeting diverse populations:

- Early Education:Integrate financial literacy into school curricula to instill sound financial habits in young minds.

- Community Outreach Programs:Offer workshops, seminars, and online resources to educate individuals on financial management, budgeting, and investment.

- Workplace Initiatives:Encourage employers to provide financial literacy training to their employees, empowering them to make informed financial choices.

- Targeted Programs for Underserved Populations:Design programs tailored to specific needs of low-income individuals, immigrants, and seniors, addressing their unique financial challenges.

Applications to Personal Finance

The lessons learned from “A Tale of Two Savers” provide valuable insights for managing personal finances effectively. By understanding the principles of saving and investing, individuals can develop sound financial habits and achieve their financial goals.

Developing sound saving and investment habits requires discipline and a clear understanding of financial concepts. Individuals should set realistic financial goals, create a budget, and allocate funds accordingly. Regular saving, even in small amounts, can accumulate over time and build a solid financial foundation.

Investing in a diversified portfolio of assets, such as stocks, bonds, and real estate, can help individuals grow their wealth and reach their financial objectives.

The Role of Financial Advisors

Financial advisors can play a crucial role in helping individuals achieve their financial goals. They provide personalized advice, tailored to an individual’s specific financial situation and objectives. Financial advisors can assist with:

- Developing a comprehensive financial plan

- Managing investments and risk

- Tax planning and estate planning

- Retirement planning

Choosing a qualified and experienced financial advisor is essential. Individuals should research and interview potential advisors to find one who aligns with their financial goals and values.

General Inquiries

What are the key themes explored in A Tale of Two Savers?

The story delves into themes of saving, investment, risk management, and the impact of financial literacy on individuals and society.

How does the story illustrate the importance of financial literacy?

By contrasting the financial outcomes of two savers with different levels of financial literacy, the story highlights the consequences of poor financial decisions and the transformative power of financial knowledge.

What practical tips can individuals derive from A Tale of Two Savers?

The story offers valuable insights into developing sound saving habits, understanding investment principles, and seeking professional financial advice to achieve financial goals.